Last week a video on wealth inequality in the US went viral. It shows the stark differences between the way Americans think wealth is distributed now, the way they think it should be, and the way it really is. It raises a compelling point: many Americans are unaware of the serious extremes of wealth in the U.S.

The realities of wealth in America are incredibly different from our common narrative. In a country that puts a spoonful of the American Dream in every child’s bottle, we are raised to believe that wealth is acquired through hard work, an entrepreneurial spirit, determination and perhaps a little luck. A 2012 Pew Research Center report found that 68 percent of Americans agreed that “most people who want to get ahead can make it if they are willing to work hard.” The wealth gap then is perhaps not such a problem because anyone in America could wake up every morning and dive in for a swim in their massive wealth of gold coins if they put in enough time, energy, and creativity to make it happen.

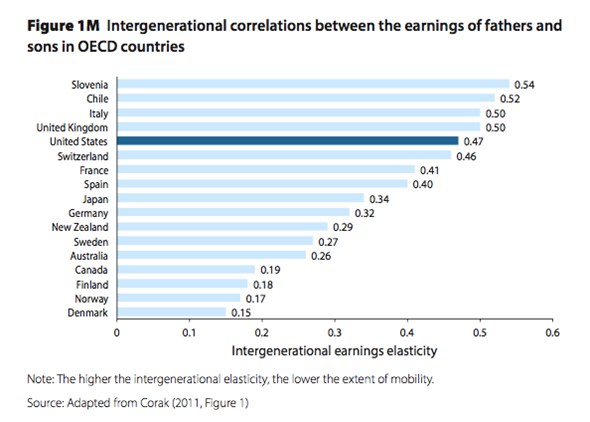

Yet some research reveals major holes in this view of our great country. America is not the dream of economic mobility that we promote in the brochures. Intergenerational earnings elasticity shows how well a father’s earnings is a predictor to the earnings of his son. In other words how does the economic status of your birth affect how much money you can make when you grow up. The higher the number the lower the economic mobility. As you can see in the chart below the United States is pretty low on the economic mobility pole when compared with other developed countries.

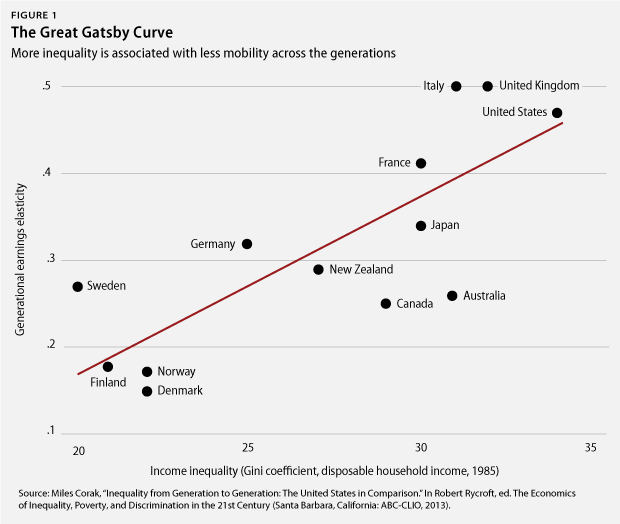

Furthermore a report by Miles Corak from the Center for American Progress suggests that the increase in wealth inequality actually leads to a decrease in opportunity. Contrary to the point of view that the increasing gap between the top 1 percent and the rest of America is incentivizing people to increase their personal wealth, this report shows that there is a correlation between income inequality and a decrease in economic mobility called the “Great Gatsby Curve.”

The report looks at three contributors to economic mobility:

- Your family‘s ability to invest in your future

- The resources and incentives available to you in the market

- The investments provided by the state to promote economic mobility

Let’s just look at the first of these three factors. If more and more wealth is held by fewer and fewer people then there are fewer and fewer families with the resources to invest in their child’s future and fewer and fewer children with the education, support, and resources they need to move up the ladder. While we like to promote the idea that the world’s billionaires made their fortune with their own sweat, many of them got a huge head start with privileges they received by the sheer lottery of their birth. One of the biggest is access to credit and access to capital, which often comes from their parents. It’s a lot easier to build wealth when you have a little to begin with. Again, as less and less wealth is held in the hands of the many, that means there are fewer resources for more people to build wealth, and thus less economic mobility.

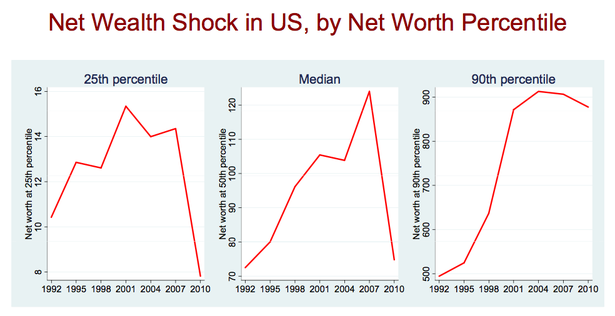

Less wealth also means less economic stability. This chart, tweeted by Amir Sufi at the University of Chicago, shows how the recession affected people at different income levels. Those with a lot of wealth depend less and less on their incomes and have a lot more to fall back in times of economic hardship. An economic recession can serve to widen economic inequalities.

The only thing more troubling then the lack of upward mobility in the US, is the number of families experiencing downward mobility. Now more people are struggling just to maintain their economic existence. They are not moving up the ladder but preventing themselves from falling into the chute of poverty. Pew Research data shows that the medium income and net worth is falling and 85 percent of the middle class in America report it is harder to maintain their lifestyle. As part of the first generation to be worse off then the one before, I was making substantially less then my parents made in their first jobs out of college. Daniel Luzer quotes David Frum’s brilliant description of the American worker in his article on The Social Mobility Fairytale:

You are a white man aged 30 without a college degree. Your grandfather returned from World War II, got a cheap mortgage courtesy of the GI bill, married his sweetheart and went to work in a factory job that paid him something like $50,000 in today’s money plus health benefits and pension. Your father started at that same factory in 1972. He was laid off in 1981, and has never had anything like as good a job ever since. He’s working now at a big-box store, making $40,000 a year, and waiting for his Medicare to kick in.

Now look at you. Yes, unemployment is high right now. But if you keep pounding the pavements, you’ll eventually find a job that pays $28,000 a year.

As incomes fall, the ability to build something for yourself diminishes because you are now struggling just to meet basic needs. The part of the narrative of the American Dream I love is the idea that we all possess the talent, creativity, resources, and ability to make it big. I love that I live in a country where invention and entrepreneurship is celebrated above all else. I also love the idea that we are a country where everyone can create a good life if they work hard enough. We’re not talking about being the next Bill Gates, but just having that white picket fence or whatever success looks like to you. Yet the growing wealth gap in the United States is stealing that dream from most of us. It is becoming harder and harder for the average person to build wealth no matter how hard or smart they work.

The question then is how do we go about closing the gap and ensuring everyone has the resources they need for economic mobility? From the very beginning I’ve looked at how to forge an economy that allows us all to meet our needs while building a healthy community. In my next post I’ll explore a diversity of solutions that specifically tackle this problem of wealth inequality in America. Until then I’d appreciate your thoughts below on how you think we should tackle this growing problem.

To be continued…

[…] [Reposted from ChangeEngine] […]